Advertising, Amazon, Amazon PPC, Ecommerce, Pay per click

Singapore Amazon in 30 days.

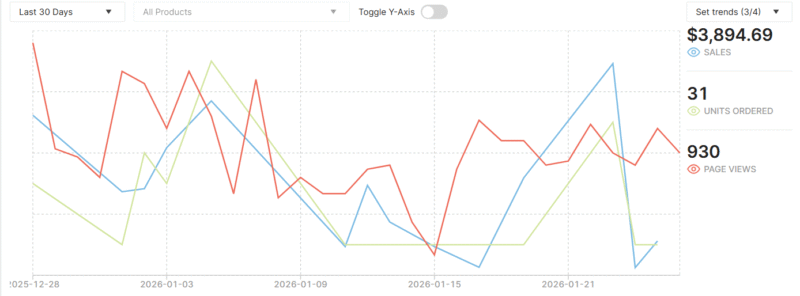

$3,894 in sales. 930 page views. 31 units sold.

Here’s the brutal truth about “emerging markets.”

Everyone says: “Expand to Singapore! Untapped opportunity!”

Nobody says: “Prepare for chaos.”

Last 30 days breakdown:

- Dec 28: Decent start

- Jan 3: Spike (excitement!)

- Jan 8: Crash (confusion)

- Jan 15: Rock bottom (all metrics died)

- Jan 21: MASSIVE spike (blue line 3x normal)

The pattern? There isn’t one. That’s the problem.

Here’s what I learned selling in Singapore:

“High page views = sales” – 930 views, 31 units. 3.3% conversion. Ouch.

“Small market, easier to dominate” – Wrong. Small = volatile. One competitor stockout = your spike. They restock = your crash.

“Replicate your US/UK strategy” – Tried it. Failed. Singapore shops differently: price-sensitive, reviews-obsessed, shipping-paranoid.

What actually works:

✅ Accept volatility – 31 units/month won’t feed you. It’s market testing, not revenue.

✅ Bundle products – $125/unit average ($3,894 ÷ 31). High AOV required because volume is low.

✅ Time your launches – Jan 21 spike? Chinese New Year prep. Market knowledge = survival.

✅ Diversify markets – Singapore alone? Risky. SG + AU + JP = stable portfolio.

Real talk:

If someone promises you “easy Singapore profits,” run.

But if you want to learn a market that teaches you resilience? Singapore is your MBA.

My advice:

Don’t launch here for revenue. Launch here for data.

Test pricing, messaging, and product-market fit with minimal risk. Then scale where it works.

Question: Have you expanded to Singapore or another “small” Amazon market? What surprised you most?